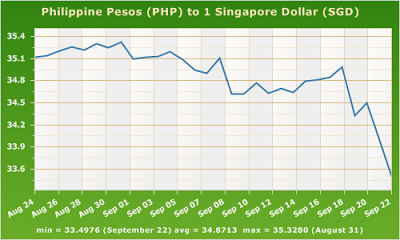

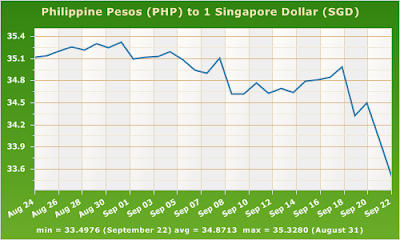

Oh my gosh. Look at that declining trend! Investors are exposed to the sinking Singapore dollar. Why has the SGD been weak these past weeks?

Is there a rebound in sight? So Singapore, too, is badly affected by the worldwide economic breakdown and crisis?

I thought the SGD should be on a sustained trend of appreciation still because it’s a business and investment hub of neighboring countries in Asia and also some parts of the world (e.g. Europe) as AU/UK is tightly connected to its finances.

Now I’ve read in the newspaper that Singapore’s inflation unexpectedly accelerates as housing and food costs climb. Well, it seems set for a choppy ride this year as well, and probably the next upcoming (?).

The lowest SGD versus PHP from the time I came here was $30.86 (on July 17) and the highest was $35.34 (July 18–the next day!).

I’m not an expert in the interplay of economics, politics and currency trading that drive global currency values, but I don’t fret because I know that the Singapore dollar is backed by solid fundamentals. The island-state boasts an enviable foreign-exchange war chest of great amount of $ reserves and account surplus anyhow.

So how?

In the midst of all these fiscal downturns, most people’s advice is to invest in gold. The premise is pretty simple. Generally, the price of gold tends to move in the opposite direction of the dollar for these reasons:

- A falling dollar may lead to inflation in the U.S. due to rising import prices, and gold is a traditional inflation hedge.

- Anxious stock portfolio holders and investors often keep the dollar because they seek safety in uncertain times. However, when the greenback shows signs of weakness, many of these jittery investors move on to gold. And as the dollar drops to new lows, gold will be rising to new highs.

But despite gold’s reputation as a safe haven, it’s actually one of the most volatile investments around.

Given its flightiness, I don’t think gold is a good choice for most people. It’s the kind of investment individuals are more likely to buy after it’s had a big run, which is precisely when it’s most vulnerable to a big fall or a long period of stagnation.

I think it would be best to invest in love instead. ![]() Invest in people who live out the call to love. including yourself. Invest in good relationships and people who are committed to shifting the paradigms of the world and challenging the status quo that is calling for aggression, crisis and [unnecessary] over-consumption.

Invest in people who live out the call to love. including yourself. Invest in good relationships and people who are committed to shifting the paradigms of the world and challenging the status quo that is calling for aggression, crisis and [unnecessary] over-consumption.

Leave a Reply